Getting My Insurance Account To Work

Wiki Article

All about Insurance And Investment

Table of ContentsThe Only Guide for Insurance Asia AwardsThe Basic Principles Of Insurance Expense The 5-Minute Rule for Insurance Agent Job DescriptionThe Best Strategy To Use For Insurance AdvisorThe 20-Second Trick For Insurance CodeInsurance Commission Can Be Fun For Anyone

Disability insurance coverage can cover long-term, short-term, partial, or complete impairment. It does not cover medical care and services for long-lasting care. Do you require it? The Facility for Disease Control as well as Prevention states that nearly one in four Americans have a handicap that affects major life events, which makes this sort of insurance coverage sensible for everyone, even if you're young and also single.

Life Insurance for Kids: Life insurance exists to replace lost revenue. Accidental Fatality Insurance Coverage: Also the accident-prone ought to avoid this kind of insurance coverage.

These are the most essential insurance types that offer huge financial relief for really reasonable circumstances. Outside of the 5 major kinds of insurance policy, you ought to assume thoroughly before buying any additional insurance.

The Definitive Guide to Insurance Companies

Bear in mind, insurance is indicated to secure you and your finances, not injure them. If you require help with budgeting, try making use of a expense payment tracker which can aid you keep all of your insurance policy settlements so you'll have a much better grasp on your personal finances. Associated From spending plans and bills to totally free credit history and more, you'lldiscover the effortless means to remain on top of everything.There are many insurance policy options, as well as lots of financial professionals will claim you require to have them all. It can be tough to establish what insurance coverage you really require.

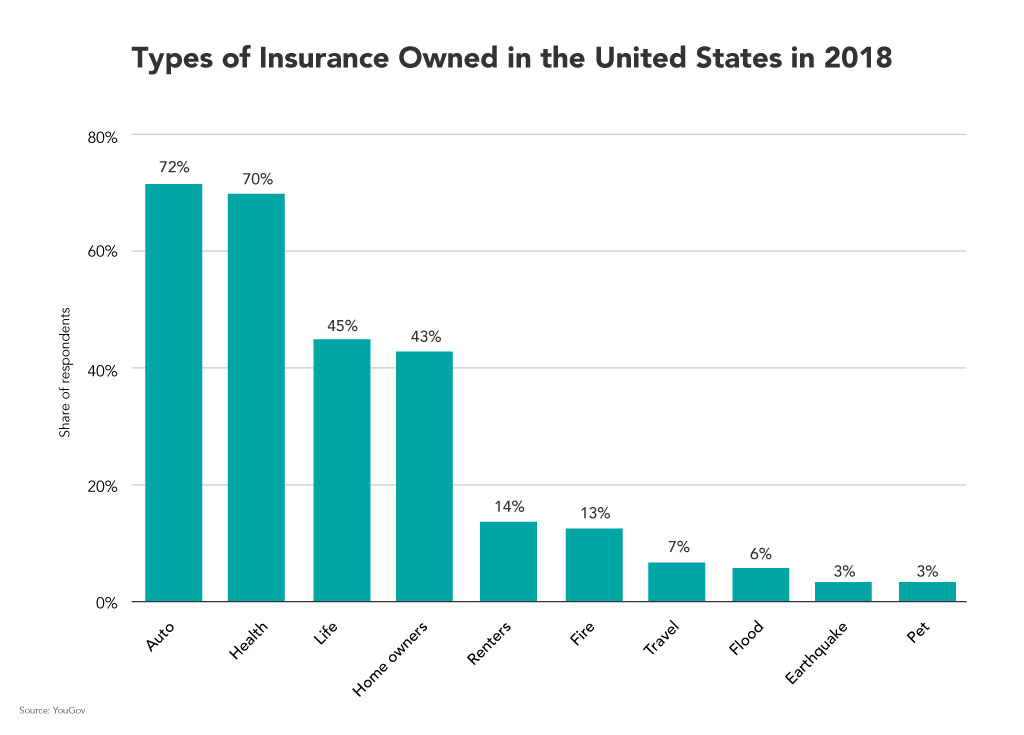

Aspects such as kids, age, lifestyle, and also work advantages play a role when you're building your insurance profile (insurance agent job description). There are, nevertheless, 4 sorts of insurance policy that a lot of financial specialists recommend most of us have: life, health, automobile, and long-term handicap. 4 Sorts Of Insurance Policy Everyone Needs Life Insurance policy The best advantages of life insurance coverage consist of the ability to cover your funeral expenses and offer those you leave.

How Insurance Code can Save You Time, Stress, and Money.

Both fundamental kinds of life insurance coverage are typical entire life as well as term life. Simply clarified, whole life can be made use of as an earnings device as well as an insurance coverage tool. As long as you remain to pay the month-to-month premiums, whole life covers you until you die. Term life, on the other hand, is a plan that covers you for a collection amount of time.

Typically, also those employees that have terrific health insurance policy, a great savings, and an excellent life insurance policy don't plan for the day when they could not have the ability to benefit this contact form weeks, months, or ever before once more. While medical insurance pays for a hospital stay as well as medical costs, you're still left with those daily expenditures that your income typically covers.

Not known Details About Insurance Advisor

Lots of companies provide both short- and long-term impairment insurance as component of their advantages bundle. A plan that assures revenue replacement is ideal.7 million auto crashes in the U.S. in 2018, according to the National Highway Traffic Security Management. An estimated 38,800 individuals died in auto accident in 2019 alone. The number one cause of fatality for Americans between the ages of 5 and 24 was car accidents, according to 2018 CDC information.

7 million motorists as well as travelers were hurt in 2018. The 2010 economic expenses of car crashes, including fatalities and disabling injuries, were around $242 billion. While not all states need drivers to have automobile insurance policy, the majority of do have policies relating to monetary duty in case of an accident. States that do call for insurance conduct periodic arbitrary checks of motorists for evidence of insurance coverage.

Getting The Insurance Asia Awards To Work

If you drive without car insurance and have an accident, penalties will probably be the least of your economic concern. dig this If you, a traveler, or the various other motorist is injured in the mishap, auto insurance will certainly cover the expenses and aid protect you against any type of litigation that might result from the crash.Once again, as with all insurance policy, your private situations will certainly figure out the expense of car insurance coverage. To make sure you get the right insurance for you, compare several rate quotes and also the insurance coverage offered, and inspect regularly to see if you receive lower prices based upon your age, driving document, or the location where you live (insurance quotes).

If your employer doesn't supply the kind of insurance policy you web want, acquire quotes from several insurance companies. While insurance coverage is costly, not having it might be far more pricey.

The Best Strategy To Use For Insurance Code

Insurance coverage resembles a life vest. It's a little bit of an annoyance when you don't need it, but when you do need it, you're more than happy to have it. Without it, you can be one cars and truck accident, ailment or residence fire away from drowningnot in the ocean, yet in financial obligation.Report this wiki page